What is a W9 Form?

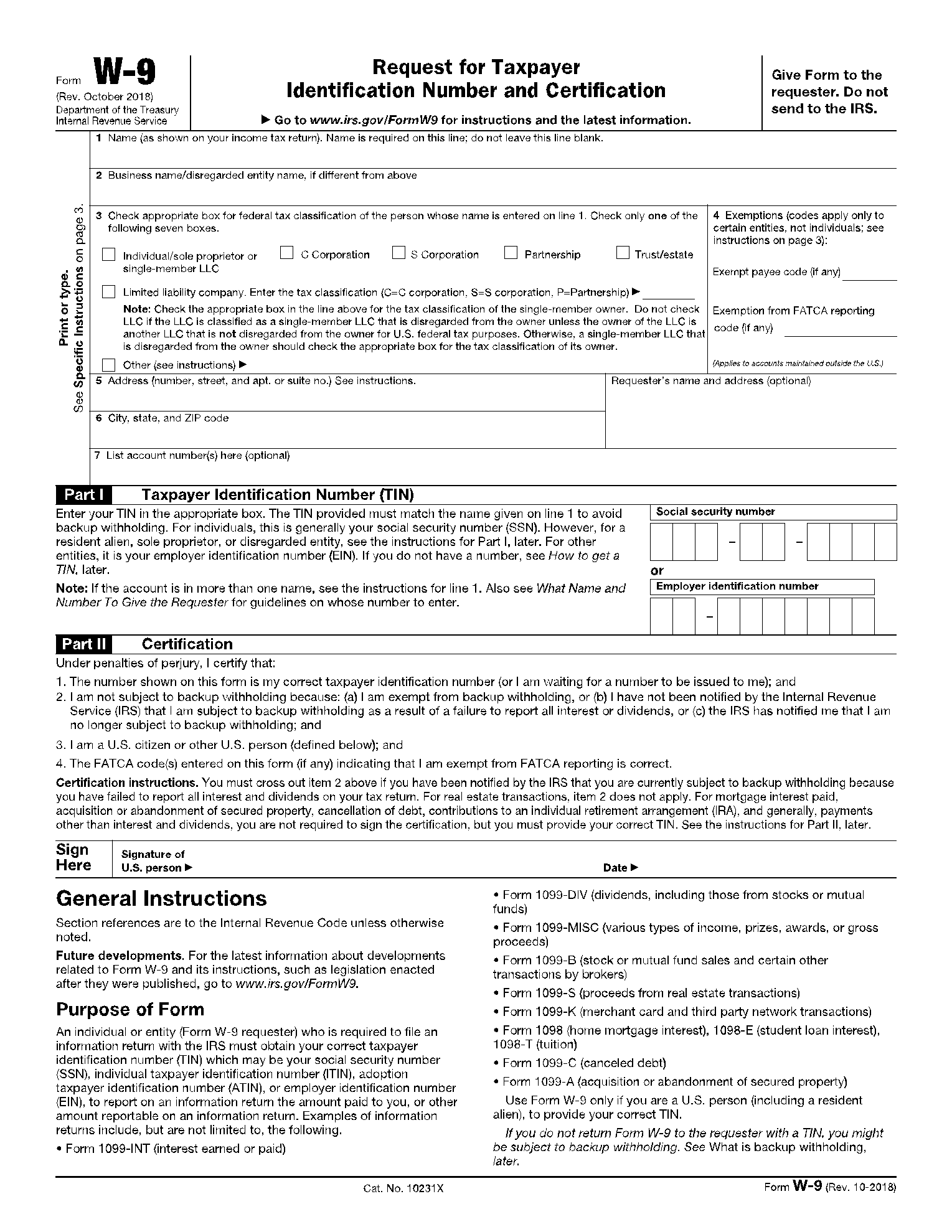

A Form W-9, also known as the Request for Taxpayer Identification Number and Certification is one of the several tax-related forms required by the Internal Revenue Service (IRS) to process tax information.

It is drafted and filled by all independent contractors who have been hired by a business in the US. In general, contractors or businesses who sublet a part of their subservience (with a value exceeding $600) to another without officially employing them are required to file a Form W-9 to indicate whom they are paying and gather information about them so that their earnings can be accurately reported at the end of a fiscal year.

Using our online signing service, one can sign and email their Form W-9 to the requester in a few, simple clicks, which makes the entire tax documentation process easier, as well as save time for contract workers and freelance entities in general.

Information included on the Form W-9

Here are some of the sections that must be present in every Form W-9.

Business name/payee name: Here, the payee is required to fill in their full names or use a business name instead if the person they are paying is a business entity.

Federal tax classification of the payee: The taxpayer is required to check the most appropriate description of their business - sole proprietorship, LLC, C corporation, S corporation, partnership, trust/estate. Individuals or entities filling the form outside the US are expected to tick the Other box instead.

Latest mailing address of the payee: The most recent mailing address of the taxpayer should be entered on the form.

Payee’s tax identification number (TIN): By default, the TIN of US citizens is their social security number, so this should be logged in for sole proprietorship enterprises. For payees that operate as an entity, the TIN is that of the employer. Resident aliens on the other hand have to apply for a special TIN.

How to Fill out a Form W-9?

A W9 form 2021 should contain what was covered in the previous section and described below is how to fill the form.

Box 1

Here, the taxpayer is required to enter their name as it appears on the income tax return.

Box 2

This is to be filled by businesses who may have filled something else in Box 1. Otherwise, leave it blank. For instance, if your name is Harry Schweinstiger, and your business doesn’t exist as a separate business entity, you are expected to leave it blank.

Box 3

Fill in the first box if you are a sole proprietor or single-member LLC. Business entities that exist as a C corporation are expected to tick the second checkbox. Others who exist as an S corporation, partnership or trust/estate are also expected to check the description that best suits them.

The checkbox for LLC should be ticked if your business has a partnership tax, C or S corp tax status. The other checkbox should be used instead if your business entity cannot be identified by any of the available descriptions.

Box 4

Here, the payee is required to write out the proper code that applies to them if they are subject to FATCA or exempt from backup withholding.

Box 5

Write out your full billable address.

Box 6

Write out the city, state, and zip code of the address indicated in Box 5.

Box 7

It’s optional to fill in this field. It should contain an account number that helps the parties involved know the purpose of the form.

Box 8

To the far right of these boxes is an unnumbered box, where the name and the address of the hiring party can be written. Note that this is also optional.

Users of this form should also pay attention to Part I and Part II which are covered in the second part of the form.

Part I - Taxpayer Identification Number (TIN)

In this section of the form, users are allowed to enter either their employer identification number (EIN) or social security number (SSN). Typically, entities filed as a corporation, partnership or multi-member LLC provide their EIN while those who filed as a single member LLC or sole proprietor provide their SSN instead.

Resident aliens who do not have an SSN are allowed by law to use their IRS individual taxpayer identification number.

Part II - Certification

This is the part where the user accedes to all that is written in the form by signing and dating it. Since appending a signature to the form shows consent to its content, users are encouraged to read through carefully before signing. The completed form should also be sent through an encrypted system to the employer, requester, or hiring party. Through an efficient system like CocoSign, you can sign this form online, and share it securely with your employer.;

What is a Form W-9 Used For?;

The Form W-9 is mostly used as an official request for a hired contractor’s taxpayer identification number (TIN) and other related information. But its use isn’t limited to that only. Here are some of its other uses:

- Prevent backup withholding: Future payments may be withheld in part or full for goods and services sold if a Form W-9 is not filled and returned to the requester or hiring party. So if the business asking for completion of the W-9 is called for questioning by the IRS over certain payments, the independent contractor can use this form as documented proof that they are not subject to backup withholding.

- IRS review

- Information return

- Proper classification of Federal tax

Who Needs a Form W-9?

A Form W-9 is to be filled by independent contractors, freelance and self-employed workers who have earned over $600 with an employer, yet do not have any official employment with them. They are not used for employer-employee relationships. A W-2 or W-4 is usually used for an employer-employee relationship instead. A Form W-9 may also be used by a financial institution to gather tax-related information about their customers.

After filling by the independent contractor, the form is sent to the hiring party or supervisor; not the IRS. As a freelancer, you may have to file a new form each time you change your tax ID number, name, business name, address, or any other relevant information contained in the form. You may also be required to fill multiple forms if you work as a freelancer or independent contractor with multiple companies.

The information gathered from the contractor is usually used by the hiring entity or business to complete a 1099-NEC form.